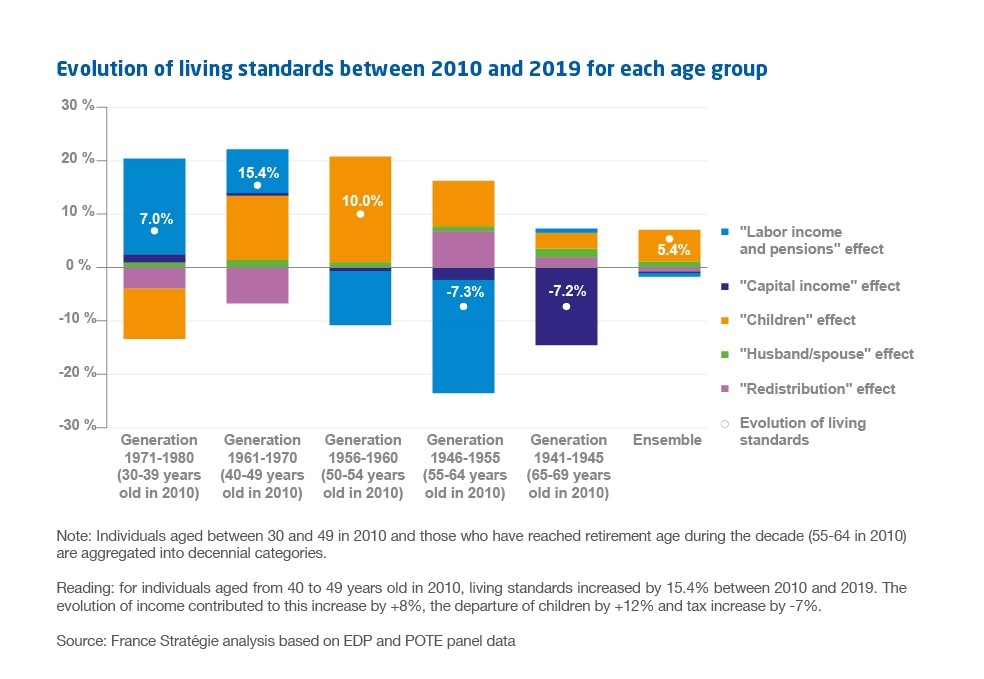

Life-cycle dynamics generally lead to an increase in primary income during the first decades of working life, before slowing down at the end of it and throughout retirement. The evolution of a household’s living standard also depends on its composition, in particular through childbirth or children leaving home. On the other hand, the redistribution system dampens the life-cycle effects thanks to tax and social benefits, although it plays a marginal role in the evolution of the average living standard from 2010 to 2019.

Regardless of age groups, living standard increased less in the 2010s than in the previous decade. Apart from individuals between the ages of 55 and 64 in 2010, who had their living standard affected by retirement, the two age groups who experienced the weaker improvement were young working-age adults (30-39 years old in 2010) and retirees (65-69 year olds in 2010). Young workers experienced a 7% increase in their living standard over the decade, although they were the less well-offs in 2010. On the contrary, the retirees (65-69 age group in 2010) were in a relatively better situation in terms of pensions and capital income but witnessed a 7% drop in their living standard. This is due to the contraction in capital income, as it does not include any pending capital gains.

Nonetheless, there is an income convergence between the wealthiest and the poorest retirees: while pensions have remained stable overall, the decreasing returns on capital affected primarily the wealthiest households. Likewise, when we consider income quintiles among young working adults, inequality slightly increased. But if we focus on individual income paths, the opposite occurs: the living standard of workers who started the decade in the bottom 20% increased by 23%, while the top 20% experienced a 2% decrease.