Such an analysis raises many methodological issues. In particular, how should pension benefits be considered? Although the pension system is mainly insurance-based, it includes significant redistributive components. Therefore, allocating pensions in full either to primary income or to redistribution is questionable. To address this issue, we integrate them into primary incomes, but test the robustness of the results obtained to this choice. Furthermore, should we consider net, gross, or "super-gross" wages including employers’ social insurance contributions? We choose “super-gross” wages, because they correspond to what the employer is prepared to pay for the work performed.

Once these methodological issues have been addressed, the main results are as follows:

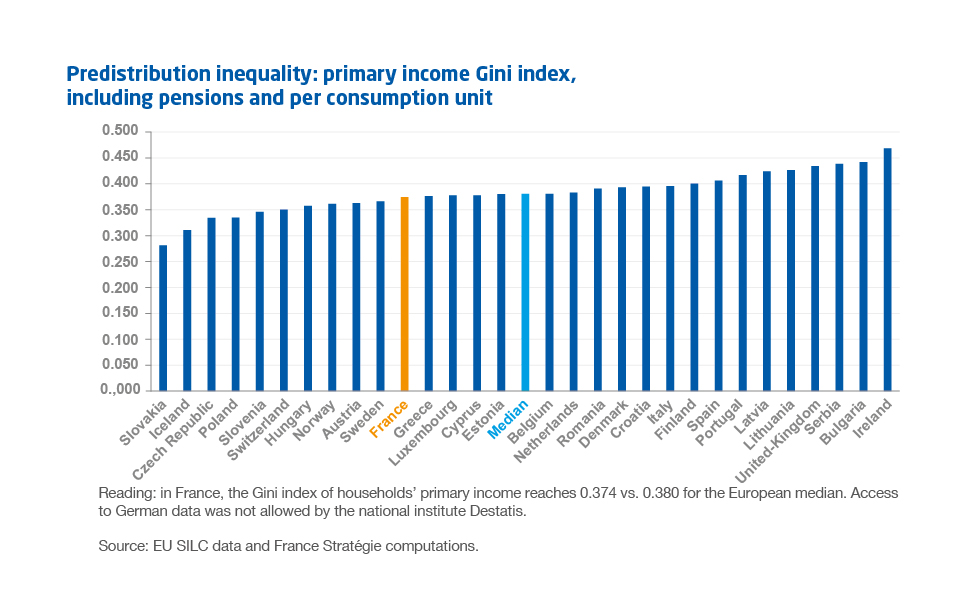

- In France, primary inequality is slightly below the median of European countries and below that of our large neighbours. This result remains true if we focus on the non-retired population.

- Redistribution plays a bigger role in reducing primary inequality in France than elsewhere, with this reduction spread almost equally between social benefits (excluding pensions) and direct

- taxes, despite the latter being six times larger.

- Social benefits reduce inequality by much more in France than the median of European countries. This is mostly due to the fact they target lower incomes more than the European median. Their volume is also above the median, albeit to a lesser extent. Taxes also prove more redistributive in France, but mainly thanks to their volume, whereas their targeting hardly exceeds the European median.

Consequently, the size of the French tax and benefits system does not result from the ine ciency of a system that would aim to compensate for strong primary inequality rather than to deal with them at the root. There is, however, room for manoeuvre to improve the redistributive performance of this system.